H1: Tax Benefits of Registering a Company in Cyprus for U.S.-Based Entrepreneurs

The Republic of Cyprus has established itself as a global hub for tax-efficient company formation. For U.S.-based CEOs, investors, and professionals—including the Greek-American and Cypriot diaspora—Cyprus offers unique legal and financial incentives that make company incorporation particularly appealing in 2025.

At E. CHATZIDIMITRIOU LLC, we guide clients in the United States through every step of Cyprus company formation—remotely, legally, and efficiently.

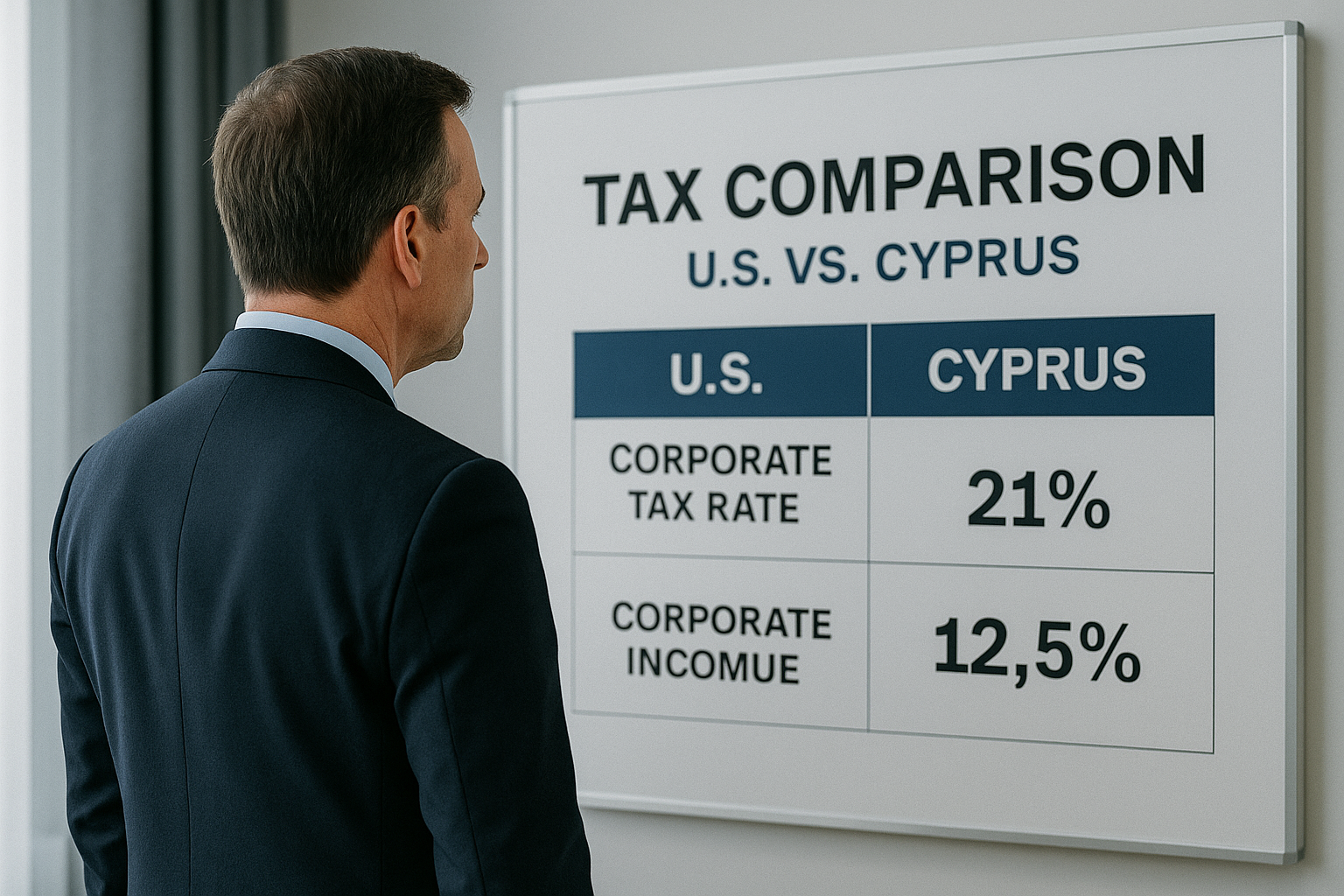

H2: Key Tax Advantages for U.S. Residents

H3: 12.5% Corporate Income Tax

Cyprus maintains one of the lowest corporate tax rates in the European Union, fixed at 12.5%. This is substantially lower than the combined U.S. federal and state tax burdens.

H3: Dividend Exemption Regime

Companies in Cyprus may benefit from exemption on dividend income, provided certain basic conditions are met. This is particularly advantageous for holding companies or investment structures.

H3: No Withholding Tax on Dividends or Interest

Non-resident shareholders (including U.S. residents) benefit from zero withholding tax on dividends, interest, and royalties.

H3: Extensive Double Tax Treaties

Cyprus has signed over 65 Double Taxation Agreements, including one with the United States, reducing or eliminating dual taxation and opening paths for strategic international structuring.

H2: Ideal for Entrepreneurs, Investors, and Consultants

Cyprus companies are often used by:

-

Startup founders in tech, ecommerce, and SaaS

-

Real estate and holding company investors

-

Business consultants with EU clientele

-

Greek-American entrepreneurs expanding into Europe

-

Professionals requiring VAT registration in the EU

Whether your goal is international tax efficiency or strategic expansion into the European market, Cyprus offers a competitive and compliant solution.

H2: Remote Company Formation with E. CHATZIDIMITRIOU LLC

Our law firm provides fully remote company formation, document filing, and legal advisory. We also offer:

-

Tax planning consultation

-

Representation before Cyprus authorities

-

Ongoing compliance services

-

Bilingual communication in Greek and English

H2: Schedule a Free Consultation Now

U.S. Phone: +13474034789

Email: info@hatzidimitriouvirtuallaw.com

Firm: E. CHATZIDIMITRIOU LLC | Legal Services in Cyprus & Greece

Online meetings available worldwide

Let our expert team help you set up your tax-optimized business in Cyprus — without leaving the U.S.